Stetson Students Prepare 285 Free Tax Returns for Families in Need

Stetson University students prepared 285 federal tax returns for free this spring to help local families in need through the Volunteer Income Tax Assistance program.

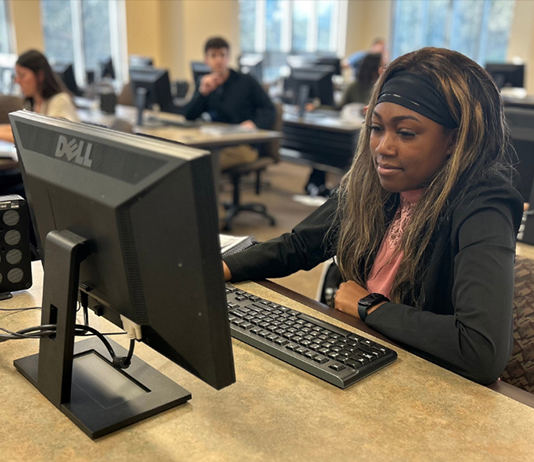

The students worked with Stetson faculty, staff and others to file the tax returns with the IRS, saving families on the cost of tax preparation while also gaining hands-on experience in finance and accounting.

Sponsored by the United Way of Volusia-Flagler Counties, Stetson’s VITA program started in 2011 (for the 2010 tax year) and has since secured federal tax refunds totaling $2,018,746 for members of the local community.

“The Stetson students enjoy participating in the VITA program because they have the opportunity to engage with the community and complete their returns while the client is present,” said Marianne Blair, Stetson’s VITA program coordinator and an Accounting instructor in the School of Business Administration.

Serving as tax preparers, the students are IRS-certified and trained to identify a taxpayer’s eligibility for federal tax credits, such as the Earned Income Credit and the Child Tax Credit, helping the families file the most accurate returns.

Stetson’s VITA program is operated through the M.E. Rinker, Sr. Institute of Tax and Accountancy. From Feb. 1 through April 15 this year:

• 31 undergraduate students volunteered to prepare tax returns, along with one master’s level student. The students worked closely with five faculty and staff members, as well as two volunteers from the community, who reviewed the tax returns for quality control.

• the students collectively logged 600 volunteer hours. The faculty, staff and community volunteers contributed another 300 hours during the tax season.

“Overall, VITA at Stetson is the ideal environment for community outreach and the students gain valuable customer service experience,” Blair said.